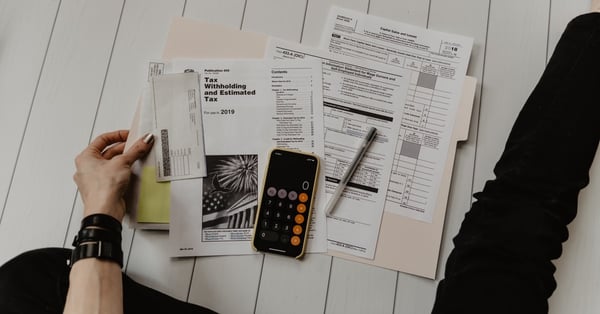

We know that VAT isn’t at the top of everybody’s priority list, but you should understand how it works when running a small business. The majority of companies register for VAT online and get set up to submit returns digitally using accounting software.

Your VAT return summarises all the transactions that took place during that VAT period but when are they due?

What Are the Payment Deadlines?

You should file a VAT form at the end of each accounting period, which is every three months. As such, you’ll file four VAT returns each year. You’ll need to include the relevant start and end dates on each VAT return.

Your VAT return should contain:

- your total sales and purchases for the period.

- the amount of VAT you owe.

- the amount you can reclaim and what your VAT refund is.

Remember, you’ll have to submit a VAT refund even if you don’t have any VAT to pay or reclaim. Now you know when VAT returns are due in the UK, here are some tips to get you started...

1. If You’re Not Already, Get Acquainted With MTD

Before you dive into the world of digital tax legislation, it's helpful to understand some of the key things you need to know about MTD.

Making Tax Digital is a ground-breaking change to how the taxation process is carried out. Not only will it make it much easier for taxpayers and businesses, but it’ll also make the system more efficient and will significantly lessen the chances of errors taking place.

2. Sign up for an MTD-Compatible Accounting Software

Migrating to cloud accounting software is also a chance for you to modernise your record-keeping and take control of your finances. When it's time to file to HMRC, you can do so directly from within the software.

To make sure you’re ready for Making Tax Digital, your software needs to be able to:

- Keep digital records accurately.

- Digitally preserve and back up these records.

- Create a VAT return from these records.

- Provide VAT data to HMRC on a voluntary basis.

EasyBooks ticks all these boxes and has all the tools that you need to help you run your business in the most efficient way possible. You can see how we weigh up against other bookkeeping apps here.

We also offer a free trial if you want to see how the app can work for you without further commitment.

3. Keep Your Digital Records Up-to-Date

Once you connect your accounting software to HMRC’s MTD system, there are a few day-to-day things you need to take care of to ensure you meet the expectations of the new digital VAT initiative. For example, you’ll need to keep digital records of relevant sales and purchases in your chosen MTD-compatible software.

Whereas in the old VAT filing system you could calculate your VAT liabilities in any way you fancied, in future your accounting software will do this for you.

Get Bookkeeping Like a Pro!

Download our handy bookkeeping checklist which includes over 15 pages of proven checks you can do in 10 minutes to help you stay organised from the very beginning.